Is the WEP/GPO a PENALTY at retirement for public employees?

Like all Americans, Arlene Chung would like nothing more than a secure retirement. While greed-driven anti-public-sector groups have popularized the notion that public employees are benefiting from lavish retirement plans, it is simply not the case for Arlene, a Fiscal Assistant for the San Bernardino County Sheriff’s Department. Due to little-known, misguided, and unfair provisions in current Social Security law, Arlene fears that poverty awaits her in retirement.

Recently, mounting bills and medical debt in the wake of her husband’s death left Arlene desperate for immediate income. In preparing for a Widow’s Benefit she qualifies for, she discovered that the day she retires, there are two different provisions of Social Security law — the Government Pension Offset (GPO) and the Windfall Elimination Provision (WEP) — that can cause large deductions in her expected Social Security retirement benefits. These takeaway provisions will apply to Arlene solely because she will be receiving a pension benefit after more than 20 years of work for San Bernardino County.

Despite 20 years of paying her fair share of Social Security taxes in the private sector as a bookkeeper before joining the County, her pension puts her under the thumb of the GPO and WEP — the perception being that her County pension will be enough to keep her secure. But, due to most of her time in the County being done for low wages, Arlene’s pension will be relatively meager. A GPO/WEP-reduced Social Security retirement benefit, in combination with this pension, leads Arlene to believe that she’ll have to go on public assistance to survive after she stops working. Because of cases like Arlene’s, for decades now, research has concluded that the GPO and WEP hit lower earners like Arlene “disproportionately hard.”

“I will have no money to spend. I would without these takeaway provisions, but that’s not the case with the way the current law works,” Arlene says, adding that she will have to retire later than she had ever expected because of GPO and WEP.

Currently, millions of Americans are suffering from financial instability posed by GPO/WEP-induced retirement takeaways. Arlene regrets not knowing about them earlier in life. No longer dreaming of traveling to see her ancestral roots in Ireland, Arlene states, “We’re all supposed to be viable in society and viable in the economy. These takeaway provisions do not make me viable.”

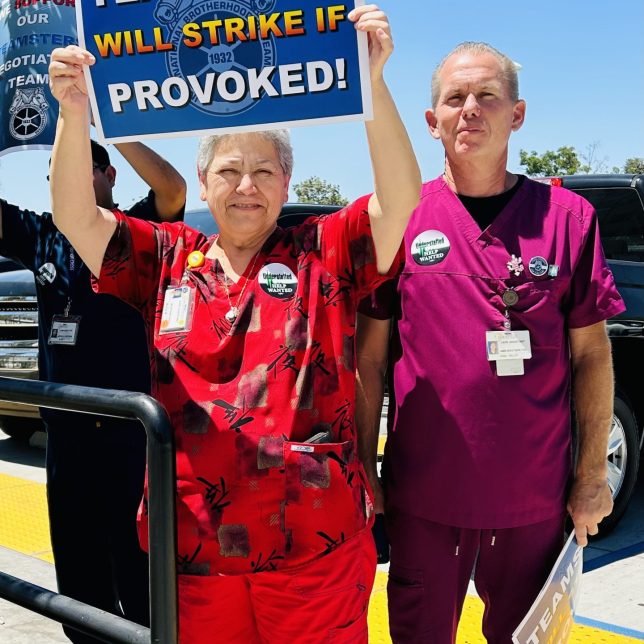

Randy Korgan, Teamsters Local 1932 General Manager, says, “After decades of contributions to their communities, working people approaching retirement should not be in a position where they start to question whether or not they’ll be able to make ends meet once they get there. When the richest 1% of Americans spend big money to spread the lie that all public employees are living large once retired, it’s people like Arlene who are hurt the most.”

“As a union that includes over 14,000 public employees,” Korgan says, “Teamsters Local 1932 is committed to protecting the retirement security of its members, and will work toward addressing the root issues at the heart of Arlene’s trouble. America is simply at its greatest when we extend a helping hand to work together.”

Read through the provision guidelines used by the U.S. Social Security Administration to see if you’ll be affected: